FAQ

Assay office permanently updates the “Frequently Asked Questions”, taking into account the news about our services as well as the legislative changes applicable to the sector

A1. What economic activities are regulated by the RJOC (Legal Framework of Jewellery and Assaying)?

The RJOC Legal Framework regulates the following activities:

Jewellery storekeeper

Buys articles with precious metal to export and sell them to other economic operators in the jewellery sector.

Artist

Designs and produces articles with precious metal that respect all of the following requirements:

- They’re for sale.

- They’re single or limited editions.

- They have a production limit of 15 articles per year.

- They contain a maximum of 10 % precious metal.

- They’re not for personal ornamentation.

Melter-assayer

Refines, smelts and tests precious metal bars or blades in legally authorised workshops and laboratories in order to supply other economic operators in the jewellery sector.

Industrial in the jewellery sector

Produces articles with precious metal, in a factory or workshop, for sale purposes.

Pawnbroker

In addition to his/her lending activity guaranteed by pledge, (s)he exposes and sells directly to the public articles with precious metal and precious metal coins that have been delivered as pledge.

Retailer for the purchase and sale of used articles with precious metal

Has an establishment open to the public, where (s)he:

- buys and sells items with used precious metal

- sells by-products resulting from the smelting of precious metal articles.

Jewellery retailer

Sells directly to the public one or more of the following articles:

- articles with precious metals

- articles of special interest

- used items.

The sale may take place in a retail outlet or by means of sale without an establishment (e.g. at fairs, by itinerant sale or by remote communication means).

A2. How can I have access to the activity of “jewellery storekeeper”, “jewellery retailer” or “retailer who buys and sells articles with used precious metal”?

In order to start one of those activities, you must submit us a “mere prior communication” and pay the respective fees (see FAQ No. A39).

Where to do that?

The mere prior communication will soon be made online through the Entrepreneur Desk.

As long as that service is not available, it must be done before one of the following Assay Offices:

| Assay office | How to submit a mere prior communication |

| Lisbon Assay Office | In person Edifício Casa da Moeda Av. António José de Almeida 1000-042 LisbonBy email contrastarias@incm.pt |

| Porto Assay Office | Temporarily closed |

| Gondomar Delegation | In person Edifício Goldpark Gondomar Rua Parque Tecnológico, s/n, 4420-330 Gondomar By email |

Required information and documents (see FAQ No. A 21)

A3. What is the difference between the main activity title and ancillary sections?

The ancillary sections are activities, other than the main activity, that are pursued within the same physical establishment.

A4. What is a Mere Prior Communication?

A Mere Prior Communication is the administrative document by which you request the issuance of the title(s) necessary for the beginning of the activity(ies).

The amount of the fee is charged for each main activity title, ancillary section or endorsement (in the case of the Remote Media title where there is more than one virtual establishment) rather than for each Mere Prior Communication.

The amount of the fee is charged for each main activity title, ancillary section or endorsement (in the case of the Remote Media title where there is more than one virtual establishment) rather than for each Mere Prior Communication.

A5. What is the expiry date of the titles that allow the exercise of the activity?

The titles have no expiry date. That is why they don’t need to be renewed.

A6. What does it mean to have good repute or to be regarded as a suitable person?

In order to be regarded as a suitable person in the framework of the RJOC (Legal Regime for Goldsmiths and Assay Offices), you must:

Not be in any of the following situations

The interested person or legal body may not:

- have been declared insolvent by a court in the last five years

- be in the process of liquidation, dissolution or closure of business

- be subject to a preventive means of liquidation of assets, in a similar situation or have a similar case pending (not applicable if the person or body is covered by a special business recovery plan).

Not have any records regarding a conviction for any of the following criminal offences

The person or legal body may not have in his/her/its criminal records any convictions for the following offences:

- offences against property

- trafficking in precious metals or gemstones

- criminal association (conspiracy)

- drug trafficking

- money laundering

- corruption – bribery

- counterfeiting

- influence peddling

- tax or customs offences provided for in the RGIT – General Rules on Tax Breaches

- swindle

- fraud in obtaining an assay mark, a mark of responsibility or its software

- counterfeiting or imitation and illegal use of an assay mark.

Please note that:

- only final convictions are taken in consideration (i.e. they may no longer be appealed against)

- only offences that may be punished with a prison sentence of more than six months are considered

- convictions in Portugal and abroad are covered

in the case of a legal body, the suitability assessment is made through the criminal records of its managers, directors or senior officers.

A7. Is there a standard model for the declaration of good repute?

Yes. Use one of the drafts that constitute Annexes I and II of Portaria No. 333-B/2017 of 3 November 2017.

Draft for legal persons (if a legal body is addressing the Mere Prior Communication)

“I, (Name), taxpayer (NIF) number…… holder of the citizen card/identity card No……., in my capacity as……….. of company……….. with head office in ……., taxpayer (NIF) number……, do hereby declare on oath, in accordance with the provisions of Articles 30 and 42, paragraph 1, of the Legal Regime for Goldsmiths and Assay Offices (RJOC) approved by Law No 98/2015 of 18 August 2015 in the wording of Decree-Law No 120/2017 of 15 September 2017, and Article 4 (k) of Portaria No 333-B/2017 of 3 November 2017, that none of the circumstances is met determining my unsuitability, or the unsuitability of the company I represent, in accordance with Article 30 of the RJOC. I further undertake to inform the Assay Office Head whenever an ulterior unsuitability situation is detected according to that legal provision.”

Draft for natural persons (if a person is addressing the Mere Prior Communication)

“I, (Name), taxpayer (NIF) number…, holder of the citizen card/identity card No….., with address at …….., do hereby declare under oath, in accordance with the provisions of Articles 30 and 42, paragraph 1, of the Legal Regime for Goldsmiths and Assay Offices (RJOC) approved by Law No 98/2015 of 18 August 2015 in the wording of Decree-Law No 120/2017 of 15 September 2017, and Article 4 (k) of Portaria No 333-B/2017 of 3 November 2017, that none of the circumstances is met determining my unsuitability, or the unsuitability of the company I represent, in accordance with Article 30 of the RJOC. I further undertake to inform the Assay Office Head whenever an ulterior unsuitability situation is detected according to that legal provision.”

A8. What is SIR licensing?

The Responsible Industry System (Sistema de Índustria Responsável – SIR) sets the rules that must be observed by those who carry out an industrial activity. In the case of activities regulated by the RJOC, this licensing covers the activities of “jewellery artist”, “melter-assayer” and “jewellery industrial”.

The licensing process takes place on the SIR platform that is accessible through Entrepreneur’s Helpdesk.

A9. I already have an activity license. What do I have to do?

Assay Offices automatically convert your license to current business titles at no cost. As long as this conversion is not done, your current license remains valid. Do confirm on this table how the conversion is done and whether you may have to deliver more documents:

This license is converted into Mere Prior Communication regarding the following activities (see Law No 98/2015 of 18 August, as amended by Decree-Law No 120/2017 of 15 September – RJOC)

| “Jewellery artist” | “Jewellery Artist” and/or “Jewellery Industrial” Please note the following:

Before converting the license, the Assay Offices may contact you so that you provide evidence of a license for the industrial activity within the Responsible Industry System (SIR). |

| “Jewellery store manager” | “Goldsmiths store manager” |

| “Pawnshop” | “Pawnbroker” |

| “Jewellery broker” | “Jewellery store manager” |

| “Melter-assayer” | “Melter-Assayer” Before converting the license, the Assay Offices may contact you so that you provide evidence of a license for the industrial activity within the Responsible Industry System (SIR). |

| “Jewellery industrial” | “Jewellery industrial” Before converting the license, the Assay Offices may contact you so that you provide evidence of a license for the industrial activity within the Responsible Industry System (SIR). |

| “Importer of precious metal articles” | “Jewellery store manager” |

| “Jewellery retailer with establishment” | “Jewellery retailer” |

| “Jewellery retailer without establishment” | “Jewellery retailer” for the respective sale without establishment. |

| “Retailer for the purchase and sale of articles with used precious metal” | “Retailer for the purchase and sale of articles with used precious metal” |

What happens if you have multiple permits?

If you have more than one business permit for the same establishment, you will have only one activity title that brings together all the activities (main and ancillary sections). For this purpose, the Assay Offices contact you so that you may indicate the main activity and the ancillary sections. Later on, you will receive information on how the license has been converted.

A10. Can I use the services of any Assay Office?

Yes. You may use the services of any assay office, regardless of the location of your establishment. Any citizen may also resort to the services of assay offices, without any geographical limitations.

A11. What is the maximum weight for an item with precious metal to be exempted from the assay mark?

The exemption from an assay mark depends on the total weight of the article. In order to calculate the total weight of an article, all metals composing it (both precious and non-precious) shall be weighed, except for non-metallic materials.

The following exemptions are covered:

The following exemptions exist:

| Article fully or partially consisting of: | Exempted if total weight is equal to or lower than: |

| Gold | 0,5 grams |

| Platinum | 0,5 grams |

| Silver | 2 grams |

Please bear in mind that:

- if the article is composed of silver and gold or silver and platinum, the total weight justifying the exemption should be equal to or lower than 0.5 grams;

- whenever you present an item to be weighed, you must present it as a whole (with precious and non-precious metals).

A12. In which cases are assaying and assay marks optional?

Assaying and assay marks are optional for:

Artist artefacts

Articles with precious metal complying with all of the following requirements:

- Being produced and signed by an artist.

- Being for sale in single or limited edition.

- Having a production limit of 15 articles per year.

- Containing a maximum of 10 % precious metal.

- Not being for personal ornamentation.

Jewellery articles of special interest

Articles with precious metal complying with all of the following requirements:

- Being of recognised archaeological, historical or artistic merit, having been manufactured before 1882.

- Containing marks of extinct municipal assay marks.

Used articles with precious metal

Articles with precious metal marketed in second hand, proven to be over 50 years old.

Raw materials for the manufacture of articles

For example, bars, plates, sheets, blades, wires, bands or pipes, provided that they are not intended to be sold directly to the public.

A13. Are articles free of the assay mark also exempt from the responsibility mark?

No. Articles must always bear the mark of responsibility in order to be marketed. The responsibility mark is the identifying mark of the economic operator who places the item with precious metal on the market.

A14. Can an assay mark be applied to an article that is exempt from that mark?

Yes. The assay mark can be optionally applied when the responsibility mark is applied.

A15. Are the mixed items of gold and silver exempt from the assay mark?

They are exempted only if they have a total weight of 0.5 grams or less. The total weight takes into account all the (precious and not precious) metals that make up the article. For more information, see FAQ No. A11.

A16. What activities are required to use a mark of responsibility?

The following activities are required to use a mark of responsibility:

- Jewellery industrial

- Artist

- Melter-Assayer

- Jewellery store manager, to mark articles with precious metal that come from other countries and which are not legalised for placing on the market

- Jewellery retailer, with or without establishment, to mark articles with precious metal that come from other countries and which are not legalised for placing on the market.

A17. What is the price for applying the responsibility mark?

The application of the mark of responsibility by punching or laser costs EUR 0.10 + VAT when set on the entire lot. The current standard price is kept in other situations.

A18. In case the lack of a responsibility mark is detected in a lot that was supposed to bear the responsibility marks, or where the mark is unreadable, what will be the price?

The price will be:

Punch — EUR 0.25 + VAT

Laser — EUR 0.41 + VAT

A19. What are the advantages of applying responsibility marks for the customer?

The Assay & Marking service becomes simpler and faster, as it takes longer to place only the assay mark than the two marks simultaneously. The time wasted when there are problems due to lack of marking or unreadable mark will be drastically reduced.

A20. What business title should a storekeeper have when buying articles with precious metal abroad?

(S)he must have the title of “jewellery store manager”. The amendment to the RJOC (Annex to Decree-Law No 120/2017) allows those who carry out this activity to buy items with precious metal and sell them to national or international economic operators.

A21. How should I fill the Mere Prior Communication?

The Mere Prior Communication is divided into 3 blocks:

- Mandatory filling block

- Block A – Activity title with establishment

- Block B – Activity without establishment

You must fill in the mandatory Block and the Block corresponding to the title you apply for.

A22. Can I ask for more than one title in a single Mere Prior Communication?

Yes. The same document serves to obtain several business titles without establishment.

In the case of business titles with establishment, you must fill in a Mere Prior Communication for each physical address.

A23. Is it necessary for an appraiser of articles with precious metals and gemological materials to be at the place of sale?

No. All you have to do is make available a list of the evaluators enrolled with the INCM so that customers may choose one, if they want to evaluate the article before buying or selling it.

A24. How much are the services of an evaluator of articles with precious metals and gemological materials?

Each evaluator is free to set the price of his/her service.

A25. Does the practice of melter-assayer require a technical manager?

Yes. The technical officer must have a professional title of “melter-assayer technical manager”.

A26. What are the obligations of the melter-assayer?

- Marking the bars or blades with the responsibility mark.

- Marking the bars or blades with the punches indicating the precious metals present and their fineness.

- Issuing an assay bulletin for each bar or blade which (s)he melts and assays, with the design of the printed mark of responsibility, the registration number of the assay, the fineness found and the weight of the bar or blade.

- If (s)he suspects that the objects or fragments of precious metal delivered for him/her to melt have archaeological, historical or artistic value, (s)he should not melt them and must report that situation to the Directorate-General for Cultural Heritage and to the Police.

- If (s)he suspects that the objects or fragments of precious metal delivered to him/her for melting have criminal origin, (s)he should not melt them and must report that situation to the Police.

- If (s)he has been handed over used items to melt, (s)he must require a written document whereby the economic operator who delivered them reported the existence of those objects to the Criminal Police at least 20 days ago.

A27. Should melter-assayers comply with the REACH Regulation?

Yes. The melter-assayer is responsible if the molten bars or blades in its premises do not comply with the REACH Regulation on the registration, evaluation, authorisation and restriction of chemicals.

More information on the REACH Regulation

A28. Should used articles with precious metal be assayed and marked to be sold at auction?

In order to sell used articles with precious metal at auction, it is necessary to:

- Ensure the assaying and marking of articles

The articles to be auctioned must be marked by an assayer. If not marked, the owner or auctioneer is responsible for requesting their assay and marking. Assay and marking are optional for:

- Jewellery articles of special interest — jewellery articles of recognised archaeological, historical or artistic merit, manufactured before 1882, or articles containing marks of extinct municipal assay marks

- Used articles with precious metal — articles with precious metal marketed in second hand, proven to be over 50 years old.

- Communicate the auction to official entities

The pawnbroker or auctioneer responsible for the auction must send, 20 days in advance, information about the auction (articles to be auctioned, date and location) to the following entities:

- Autoridade de Segurança Alimentar e Económica (ASAE) via email: asae@asae.pt

- Imprensa Nacional Casa da Moeda (INCM) via email: contrastarias@incm.pt

A29. Can the “jewellery industrial” and the “artist” sell to the public the precious metal items they produce?

No. In order to do so they will have to obtain a title for the activity of “jewellery retailer”.

A30. Do the Assay Offices provide information or clarification about the RJOC system?

Yes. You may get information or clarification by the following means:

Online

On the INCM website, at https://contrastaria.pt

By email

Through the following addresses:

At the customer information spots

- Lisbon Assay Office – Edifício Casa da Moeda, Av. António José de Almeida – 1000-042 Lisboa.

- Porto Assay Office – Rua Visconde de Bóbeda – 4000-109 Porto. (temporarily closed)

- Delegation of Gondomar – Praceta de S. Francisco, 21/25 – 4420-315 Gondomar.

A31. Are auctioneers assimilated to a “jewellery retailer” with an establishment and do they need an evaluator?

No. The RJOC does not regulate the activity of auctioneers, who must comply with the Legal Regime of the Auctioning Activity (Decree-Law No 155/2015). However, the auctioning of items with precious metals should take account of the RJOC rules (see FAQs Nos. A28 and A32).

A32. What are the rules for auctioning used articles with precious metals?

In order to auction used articles with precious metal, you’ll have to:

a) Ensure the assaying and marking of articles – The items to be auctioned must be marked by an assay mark. If not marked, the owner or auctioneer is responsible for requesting their assaying and marking. Assaying and marking are optional for:

- Jewellery articles of special interest — jewellery articles of recognised archaeological, historical or artistic merit, manufactured before 1882, or articles containing marks of extinct municipal assay marks;

- Used articles with precious metal — articles with precious metal marketed in second hand, proven to be over 50 years old.

If the article comes from another EU Member State or from Iceland, Liechtenstein or Norway, the rules laid down in Article 11(4) and (5) of the RJOC annexed to Decree-Law No 120/2017 shall apply.

b) Make available a scale and a magnifying glass

At the point of sale, the public must have access to:

- a scale having been checked by the competent authorities (metrological control);

- a magnifying glass.

Such equipment is not necessary if the auction is held at the premises or establishments for sale to the public owned by jewellery artists and retailers who sell exclusively:

- jewellery articles of special interest;

- used articles with precious metal proven to be over 50 years old.

c) Announce the auction to official entities

The pawnbroker or auctioneer responsible for the auction must send information about the auction 20 days in advance (articles to be auctioned, date and location) to the following entities:

- Autoridade de Segurança Alimentar e Económica (ASAE) via email to: asae@asae.pt

- Imprensa Nacional Casa da Moeda (INCM) via email to: contrastarias@incm.pt

d) Make available information about the article

Each article must be accompanied by the following information:

- indication that it is for sale by auction;

- value of the bidding base;

- characteristics of the precious metals comprising it (type of metal, fineness, nature and weight);

- other relevant characteristics of the article.

This information may be provided on paper or in digital format.

e) Auction the articles individually, in sets or in lots

The articles shall be auctioned:

- individually;

- in an individualised set of identical pieces;

- in lots, but only when they are pawned items (lots can never exceed the objects given in six pledge contracts).

f) Keep an electronic record of items to be auctioned or sold

The auctioneer shall keep an electronic record of mandatory communications delivered to the Criminal Police department in the area of its establishment (see FAQ No. E3).

g) Use only the allowed means of payment

Payments in cash have a maximum value, which you can refer to in the table below. If the amount to be paid is higher, the payment must be made by electronic means (e.g.: bank card), by bank transfer or by cheque (with indication of the beneficiary):

| Buyer | Maximum amount that can be paid in cash |

| · Entity subject to IRC · Person subject to IRS who has or should have organised accounts | EUR 1.000 |

| · Natural person residing in Portugal | EUR 3.000 |

| · Person not residing in Portugal and not acting as an entrepreneur or trader | EUR 10.000 |

h) These limits are identical to those applicable by law to any commercial activity.

A33. Can the “jewellery retailer” import items from countries other than EU Member States and sell them to the public?

Yes. (S)he can import articles and sell them to the public.

A34. Can articles with precious metal be presented at the assay office only by the holders of the responsibility mark?

No. Even if (s)he does not have a responsibility mark, the owner or whoever keeps the following articles must present them to the assay office for assaying and application of an assay mark:

- articles exempt from customs duties

- articles imported by private individuals for personal use

- articles with precious metal having been seized (must be presented by the competent official authorities)

- used articles with precious metal (must be presented by auction houses, lenders or retailers for the purchase and sale of used articles with precious metal)

- articles with precious metal intended for auctions (must be presented by their owners).

A35. What are the obligations laid down in the RJOC for those who were exempted from registration and license under the Assay Offices’ Regulation?

Entities that were exempted from registration and license, such as banks and other credit institutions, must have an activity permit since 2015 (Article 3 of Law No. 98/2015 of 18 August).Therefore, all entities that are not licensed yet must obtain an activity title (see FAQs No. A1 to A4).

A36. Does an article with 4 grams of silver and 0.4 grams of gold have to have an assay mark? If so, are both metals marked or just one?

The article must be marked because its total weight (4.4 grams) exceeds the weight up to which articles with gold are exempt from marking (0.5 grams). In this case, both metals are marked. For more information, see FAQ No. A11.

Even when they are exempt from an assay mark, articles must always bear a mark of responsibility.

A37. What business titles should have those who buy precious metals in order to recycle and sell them?

The necessary business titles depend on the characteristics of the activity of the economic operator who buys, recycles and sells the metals. You may confirm the titles in the table below:

| Characteristics of the operator’s activity | Business titles required |

| Resorts to a melter-assayer in order to recycle materials. Sells the recycled metal to industrialists or to other operators in the jewellery sector. Does not sell the recycled material to the public (individuals). | Jewellery storekeeper |

| Recycles the materials him/herself (does not resort to an external melter-assayer).

Sells the recycled metal to industrialists or to other operators in the jewellery sector.

Does not sell the recycled material to the public (individuals). | Jewellery storekeeper + Melter-Assayer |

| Recycles the materials him/herself (does not resort to an external melter-assayer).

Sells the recycled metal: – To industrialists or other operators in the jewellery sector; – To the public (individuals). | Jewellery storekeeper + Melter-Assayer + Retailer buying and selling items with used precious metal |

A38. Do the recycled precious metals have to be assayed and marked?

The assaying and marking of bars of precious material resulting from recycling are:

- Mandatory — when bars are sold to the public

- Optional — when bars are sold as raw material to other economic operators in the jewellery sector.

A39. What’s the fee?

The amount of the fee is charged for each main activity title, ancillary section or endorsement (in the case of the remote communication title where there is more than one Internet site) and not for each mere prior communication.

- The main activity: EUR 250,00

- The ancillary activity: EUR 25,00 (activity within the same physical establishment)

- Endorsement: EUR 15,53 (each website added to the main activity title in the mode of sale of remote means of communication)

A40. If you want to have an industrial activity title and also wish to be a jewellery storekeeper in the same establishment, what is the procedure?

You must present the mere prior communication and declare the main activity and its ancillary section, accompanied by all procedural elements (Article 4(1) of Portaria No. 333-B/2017), including the address of the establishment where the activity is led and ancillary sections.

A41. What is the difference between a jewellery retailer with establishment and without establishment?

The two definitions are centred in the jewellery retailer but correspond to two different activities:

With establishment — sells directly to the public articles with precious metal, in an establishment.

Without establishment — sells directly to the public through:

- Other methods regularly: fairs, itinerant mode, catalogue for example; or

- Remote communication means: Website, Facebook, Instagram, Marketplace (Dott, Ebay, Amazon), for example.

A42. I wish to market my articles through a website. What am I supposed to do?

If you market your articles on a website, that is you sell them directly to the public, you must have a title as jewellery retailer without establishment – remote media.

In other words, in the case of a remotely entered trading contract and not just by advertisement/shop window, you must have a title as jewellery retailer without establishment – remote media.

Example: You just need to have 1 title, the additional sites being endorsements.

A43. I already have a title as retailer with an establishment and I now intend to have a website. Do I need a new title?

Yes. A new main activity title is required: Jewellery retailer without an establishment – remote media, as long as you do business. If the website(s) is/are used for advertising purposes, no title or endorsement is required.

Each new website for marketing purposes will involve a mere endorsement (from the 2nd indicated website, inclusive).

A44. What if I have a Facebook or Instagram page?

If you already have the main title of jewellery retailer without establishment – remote media and will also market your articles on Facebook or other social network pages, you must report that to the Assay Office, for endorsement purposes.

If you do not yet have any activity title, you need to request, through a mere prior communication, the main title as jewellery retailer without establishment – remote media.

If the website(s) is/are used for advertising purposes, no title or communication for endorsement will be required.

A45. What if on my social network page I just advertise and have reference to prices?

If you only advertise your articles on Facebook, on another social network page or on any other website, with references to prices and descriptions for example, but direct customers to your website/shop and the commercial transaction takes place there, you do not need to have a remote media activity title.

A46. What if it’s another way of remote selling?

In the case of a remotely signed trading contract and not just advertising, you must have a business title as retailer without establishment – remote media, appropriate to the sale modality.

A47. What is the activity of retailer without an establishment – Fairs?

It is a non-sedentary business retail activity.

Economic operators wishing to participate in national exhibitions or fairs on an occasional basis (for a period of 30 days or less per year) do not need to have a title as retailer without establishment – fairs and must only notify the Assay Office and the Food and Economic Safety Authority (ASAE) 15 days in advance.

A48. What is the activity of a retailer without an establishment – Street vendor?

It is a retail activity carried out on an itinerant basis, including in mobile or removable premises located outside fair areas.

A49. What is sale by catalogue?

It is a contract concluded outside the commercial establishment when accompanied or preceded by the publication of catalogues. It does not apply in the case of generic advertising messages which do not involve a concrete proposal for the acquisition of goods or the provision of a service.

A50. What’s a catalogue?

It is an organised or classified list of articles for sale with images of the products or services offered by the company.

A51. What is the validity of Registries/Licences/Activities?

Registries: until 16 November 2015 – Annual

Licences: 16 November 2015 to 1 November 2017-5 years

Titles: from 1 November 2017 – unlimited

Licences granted under the RJOC, approved in the annex to Law No 98/2015 of 18 August, are automatically converted by the Assay Office into titles.

A52. What may happen if I don't have an Activity Title?

See FAQ “Administrative Offences”.

A53. If I am notified that I committed an offence, what can I do?

You may submit your defense orally or in writing, subject to the deadlines granted, after receiving the notification for preliminary hearing.

You can also refer to FAQ No. 11 the FAQ “Administrative Offences”.

A54. How can I get more information on all procedures?

On the website: www.contrastaria.pt

For Secretariat matters, at email: contrastarias@incm.pt

For Inspection matters, at email: fiscalizacao@incm.pt

You may also contact Phone No. 217 810 870

A55. Are there any differences in the completion of the Mere Prior Communication form among the various modalities “without establishment”?

Yes. The same document is used to get several business titles without establishment: fairs, street vendor, catalogue and media sales. However, please notice that:

- To obtain the title of main business activity at fairs, street vendor and catalogue sales, you can use the same Mere Prior Communication form, but each modality corresponds to a main activity title.

- In order to get the title of main business activity through remote media, you must complete the Mere Prior Communication form (Block B). Each additional website is a mere endorsement to the business activity title.

A56. I already have a title as jewellery retailer without establishment – remote media for my website (or another online means), but I now intend to market in a specific marketplace (E.g. Dott, eBay, Amazon).Do I need a new title?

No. If you already have an activity title as jewellery retailer without establishment – remote media, all you have to do is make an endorsement to the relevant title.

Where the need for this kind of endorsement occurs after the delivery of the Mere Prior Communication form, you should use the Request for Endorsements/Amendments form available at www.contrastaria.pt.

A57. What is an endorsement to the activity title?

An endorsement is requested in order to register any changes in the elements contained in the Activity Title.

A58. How can I report changes to my data, to be endorsed to the title?

By filling out an application that you may find here

A59. I wish to cancel my activity. What am I supposed to do?

You must tell us in your application that you intend to cancel the activity and send us a document certifying the cancellation. Cancellation of an activity does not give rise to the payment of any fees.

B1. What is required to be a melter-assayer technical manager?

It is necessary to hold a professional title of “melter-assayer technical manager”.

The following is required to obtain the title:

- be considered a suitable person (see FAQ no. 6)

- pass the melter-assayer technical manager examination.

The rules for obtaining this professional title are set out in Directive 333-B/2017, of 3 November.

B2. What are the requirements to be a valuer of articles of precious metals and gemological materials?

It is necessary to hold the “valuer of articles of precious metals and gemological materials” professional title.

The following is required to obtain the title:

- be considered a suitable person (see FAQ no. 6)

- pass the examination to become a valuer of articles of precious metals and gemological materials.

The rules for obtaining this professional title are set out in Directive 333-B/2017, of 3 November.

B3. How can I take the melter-assayer technical manager examination?

Where to submit the application

You must submit your examination application at one of the assay offices, either in person or by email.

Required documents

The following documents must be submitted with the application:

- registration form (download form)

- updated criminal record certificate

- one of the following two qualification certificates:

- completion of the 12th year of schooling in the scientific-humanities courses, with a pass in the discipline of chemistry

- completion of a qualification obtained through one of the double certification modalities of the Portuguese education and training system, including chemistry content, and that awards a qualification level 4 on the National Qualifications Framework (NQF) and the European Qualifications Framework (EQF)

- Certificate of qualifications proving the completion of the following short-term training units (UFCD) of the National Qualifications Catalogue (NQC), obtained through the assay offices or another certified entity:

- UFCD 10644 – Qualitative assay of precious metals (25 hours)

- UFCD 8967 – Quantitative assay and casting of precious metals (50 hours)

- Declaration of suitability (see FAQ no. 7).

B4. How can I apply for the examination to become a valuer of articles of precious metals and gemological materials?

Where to submit the application

You must submit your examination application at one of the assay offices, either in person or by email.

Required documents

The following documents must be submitted with the application:

- registration form (download form)

- updated criminal record certificate

- certificate proving the completion of the 12th year of schooling obtained through one of the modalities of scientific-humanities or double certification, with level 3 or 4 on the National Qualifications Framework (NQF) and the European Qualifications Framework (EQF);

- Certificate of qualifications proving the completion of the following short-term training units (UFCD) of the National Qualifications Catalogue (NQC), obtained through the assay offices or another certified entity:

- UFCD: 10644 – Qualitative assay of precious metals (25 hours)

- UFCD 10645 – Valuation of articles of precious metals (50 hours)

- UFCD 10646 – Gemological materials (50 hours).

- declaration of suitability (see FAQ no. 7).

B5. What is a double certification qualification?

It is a qualification that provides two certifications:

- a professional certification

- a non-higher level school certification.

These qualifications can be obtained by taking a training course at one of the following entities:

- a training entity forming part of the National Qualifications System (NQS) network

- a Professional Teaching and Qualification Centre (PTQC).

B6. What is the National Qualifications Catalogue (NQC)?

An official document defining the Short Term Training Units (UFCD) necessary to obtain a national double certification qualification at a non-higher level.

B7. If I have a qualification in the area of jewellery, other than UFCD 10644 10645, 10646 or 8967, can I apply for the examination to obtain the professional title?

No. You must have the necessary UFCD, which you can obtain if you attend a training course at our assay office unit or through another certified entity:

| Desired professional title | Required UFCD (published in the Work and Employment Bulletin of 15/02/2020 |

|---|---|

| Melter-assayer technical manager |

|

| Valuer of articles of precious metals and gemological materials |

|

B8. Is there a minimum level of education for attending the UFCD 10644, 10645, 10646 or 8967?

Yes. To attend the training course, you must have completed at least the 3rd cycle of basic education (9th year of schooling or equivalent).

B9. Is there a minimum age for attending the UFCD?

Yes. To attend the training course, you need to be at least 18 years old when you start the course.

B10. Are UFCD 10644, 10645, 10646 or 8967 published in the National Qualifications Catalogue (NQC)?

Yes. You can consult the catalogue at http://www.catalogo.anqep.gov.pt/PDF/QualificacaoReferencialPDF/1646/EFA/tecnologica/215315_RefTec

B11. How can I find out the date and location of the next UFCD 10644, 10645, 10646 or 8967 training courses?

Our Assay Office unit runs training courses in the following areas:

- testing and casting

- valuation of precious metals and gemological materials.

The courses and their conditions (program, date, location and cost) are announced on our website.

B12. Can the professional titles of melter-assayer and valuer be suspended?

Titles can be suspended in three situations:

- If the holder is no longer considered a suitable person

- If the holder has committed a serious or very serious administrative offence as provided for in the Legal Regime for Goldsmiths and Assay Offices RJOC and fined, the INCM or ASAE (Food and Economic Safety Authority) may also suspend his/her activity title if:

- the holder is convicted, without any possibility of appeal, of a crime related to the activity that is carried out

- it is proven, during administrative offence proceedings, that the holder repeatedly and seriously failed to follow the rules of the Legal Regime for Goldsmiths and Assay Offices (RJOC).

- If the holder makes more than two proven errors in the values of the valuations that he/she performs, even if this is due to negligence, the ASAE may suspend his/her title after an INCM hearing.

Suspended titles must be handed in to an assay office.

B13. I was a melter-assayer or official valuer before the Legal Regime for Goldsmiths and Assay Offices (RJOC) (annex to Decree-Law no. 120/2017). Do I have to do anything?

No. If you have a registration to perform the activity, under the scope of the Assay Office Regulation (Decree-Law 391/79), it is automatically converted to the functions defined in the Legal Regime for Goldsmiths and Assay Offices (RJOC):

- the melter-assayers will now have the functions assigned to the melter-assayer technical managers

- the official valuers will now have the functions assigned to the valuers of articles of precious metals and gemological materials.

B14. What are the functions of a melter-assayer technical manager?

A melter-assayer technical manager must ensure strict technical control over the activity of operators in the jewellery sector who test and cast precious metals. Their main functions are:

- to assay precious metals according to the assay methods defined in the Legal Regime for Goldsmiths and Assay Offices (RJOC)

- sign the test report issued for each bar or sheet that is cast and assayed

- ensure the correct marking of the bars or sheets with:

- the sponsor’s punch

- punches indicating the precious metals that are present and their respective finenesses

- melt precious metals to ensure homogeneity

- refine the precious metals.

B15. What are the functions of a valuer of articles of precious metals and gemological materials?

The valuer of articles of precious metals and gemological materials has the following functions:

- value articles of precious metals

- value gemological materials

- for the purpose of exemption from customs duties, check articles of precious metals subject to a re-import or temporary import and export regime.

He/she is under the obligation to follow these rules:

- issue certificates for any valuations that are made

- keep an electronic record of valuations that are made, with the following information:

- sequential order number

- designation, quality, quantity and weight of the valued objects

- designation of gemological materials

- the name and address of the person requesting the valuation

- the valuation and the amount charged for the valuation

- must not value bars of precious metal that are not marked by the assay offices or by an independent testing and marking organisation recognised in accordance with the definition in the Legal Regime for Goldsmiths and Assay Offices (RJOC) [article 3(gg), and articles 7 and 8 of the RJOC annexed to Decree-Law no. 120/2017].

Valuers are responsible to the injured parties for any damages resulting:

- from errors that they make in the valuations that they perform

- from deviations in their valuations that exceed:

- 1 % of its value, for bars

- 10 % of its value, for artefacts without gemological material

- 20 % of its value, for gemological materials or for the set of artefacts in which they are encrusted.

C1. What precious metals exist and what are their legal finenesses?

Precious metals that form part of the composition of articles of precious metal to be put onto the market in Portugal have the following legal finenesses:

| Precious metal | Legal Finenesses |

|---|---|

| Platinum | 999 ‰, 950 ‰, 900 ‰, 850 ‰ |

| Gold | 999 ‰, 916 ‰, 800 ‰, 750 ‰, 585 ‰, 375 ‰ |

| Palladium | 999 ‰, 950 ‰, 500 ‰ |

| Silver | 999 ‰, 925 ‰ 835 ‰, 830 ‰, 800 ‰ |

C2. What are the legal finenesses of used articles of precious metal that are proven to be over 50 years old?

At the request of the interested party, any used articles proven to be over 50 years old can have the following approximate finenesses, with tolerances of 10 (per thousand) for clean metal.

- Gold fineness: 800 ‰

- Silver fineness: 833 ‰

- Gold watches, glasses and bezels: 750 ‰

- Platinum fineness: 500 ‰

These legal finenesses came into force on 31 October 2019 (in other words, two years after the publication of Directive no. 333-B/2017, of 31 October).

C3. What assay office marks need to be applied to used articles of precious metal that are proven to be over 50 years old?

| Type of article | Applied assay office mark |

| Platinum articles with a 500 ‰ fineness | A butterfly based on the number 500 |

| Gold articles with 800 ‰ fineness | A dragonfly based on the number 800 |

| Silver articles with a 833 ‰ fineness | A ladybird based on the number 833 |

| Gold watches, glasses and bezels | A bee based on the number 750 |

C4. What are composite artefacts?

Composite artefacts are those whose composition includes precious metals and non-precious metals:

- articles with precious metal parts and ordinary metal parts

- watches with precious metal cases and ordinary metal workings

- watches with ordinary metal cases and precious metal workings.

C5. What are the technical rules for composite artefacts?

In composite artefacts:

- the ordinary metal:

- must be visible and distinguishable by colour

- should not be used for technical reasons

- the precious metal:

- must be of a thickness that allows the legal fineness of the alloy to be determined by one of the analysis methods used by the Assay Offices (see FAQ no. 58)

- if applicable, each metal must have at least the minimum required fineness (articles 14 or 15 of the Legal Regime for Goldsmiths and Assay Offices (RJOC) annexed to Decree-Law 120/2017).

C6. What are mixed artefacts?

Mixed artefacts are artefacts consisting of different types of precious metals.

C7. What are the legal finenesses of special interest jewellery artefacts?

If it is necessary to mark the artefact, the following rules apply:

| Nature of the artefact | Legal fineness |

| Special interest jewellery artefacts marked with punches of former municipal assay offices | Metal fineness may not be less than 750 ‰ |

| Special interest jewellery artefacts of recognised archaeological, historical or artistic merit, manufactured before 1882 | Metal fineness may not be less than 375 ‰ |

C8. What analysis methods does the assay office use to determine fineness?

The assay office must use the most appropriate analysis method. The methods are described below:

| Precious metal | Method used |

| Gold | Cupellation or microcupellation |

| Silver | Potentiometric titration |

| Platinum | Inductive Plasma Emission Spectroscopy (ICP) |

| Palladium | Inductive Plasma Emission Spectroscopy (ICP) |

| All precious materials | X-Ray Fluorescence Spectroscopy |

However, the Assay Office director may authorize the use of other analysis methods that are:

- justified by scientific and technical advances

- technically justified, if proposed by the laboratories and subject to the opinion of the heads of the assay office.

In each assay, the number of assay samples from each bar and the number of assayed articles of precious metal in each batch are as deemed necessary and sufficient to allow the assay office to conclude the following:

- the homogeneity of the alloy over the entire length of the bar

- the homogeneity of the batch, based on specific sampling criteria defined for that batch.

C9. What are the technical rules for mixed artefacts?

In mixed artefacts:

- the different precious metals must be distinguishable by colour

- if applicable, each metal must have at least the minimum required fineness (articles 14 or 15 of the Legal Regime for Goldsmiths and Assay Offices (RJOC) annexed to Decree-Law 120/2017).

- precious metal parts should only be marked if their thickness allows the legal fineness of the alloy to be determined by one of the analysis methods used by the Assay Offices (see FAQ no. 58).

C10. What are artist artefacts?

Precious metal artefacts that meet all of the following conditions:

- Produced and signed by an artist.

- Unique or limited edition for sale.

- A production limit of 15 articles per year.

- Contain a maximum of 10 % precious metal.

- They’re not for personal decoration.

C11. Should economic operators in the jewellery sector respect the REACH regulation?

Yes. Holders of sponsor’s mark must respect the REACH regulations, provided that the articles that they put onto the market contain substances subject to the rules of this regulation.

C12. What is the minimum precious metal fineness of special interest jewellery artefacts marked with punches of former municipal assay offices?

The minimum fineness is 750 thousandths.

C13. What is the minimum precious metal fineness of special interest jewellery artefacts of recognised archaeological, historical or artistic merit, manufactured before 1882?

The minimum fineness is 375 thousandths.

C14. What is required to request the assay and marking of special interest jewellery artefacts?

A jewellery artefact of recognised archaeological, historical or artistic merit, manufactured before 1882, may be submitted to an assay office for assay and marking. For this purpose, it must be accompanied by:

- a certificate proving its age, with a photograph of the artefact, issued by an external expert

- the CV of the external expert.

Additionally, the assay offices may:

- call upon another external expert or the Directorate General for Cultural Heritage

- request an opinion from the Goldsmith Advisory Board.

C15. What is the difference between “articles of precious metal” and “artefacts of precious metal or jewellery artefacts”?

“Articles of precious metal” include “artefacts of precious metal or jewellery artefacts”.

Articles of precious metal

The following are considered as articles of precious metal:

- artefacts of precious metal or jewellery artefacts

- composite artefacts

- medals and precious metal commemorative objects

- precious metal bars.

Artefacts of precious metal or jewellery artefacts

- These can all be defined as “precious metal articles”.

- These are artefacts consisting of precious metals or alloys of these metals, undecorated or decorated with stones, pearls, enamels or other non-metallic materials.

- They include mixed precious metal artefacts and precious metal watches with cases made of precious metal (composite artefacts, medals and precious metal commemorative objects, and precious metal bars are not included).

- Coated or plated articles whose base metal is a precious metal with a legal fineness are included.

C16. What is the difference between “articles of precious metal” and “artefacts of precious metal or jewellery artefacts”?

Articles must be made such as to reduce the number of welds to the minimum strictly necessary; the rules set out in article 3 of Directive no. 374-A/2017, of 31 October, must be complied with.

The welds that are used must have the same legal fineness, with the following exceptions:

| Location | Exception |

| In the filigree and gold watch cases | The use of gold welds is permitted with a difference of less than 10 ‰ |

| In gold artefacts with fineness of 916 ‰ or higher | The use of gold welds with a fineness of 750 ‰ or higher is permitted |

| In white gold articles | The fineness of gold welds is 585 ‰ or higher. Except for the 375 ‰ articles, in which the weld has the same fineness. |

| In silver artefacts with fineness of 925 ‰ or higher | The minimum fineness of silver solder is 650 ‰ |

| In silver artefacts with a fineness of less than 925 ‰ | OThe minimum fineness of silver solder is 550 ‰ |

| In platinum artefacts | The weld consists of precious metals with a minimum proportion of 800 ‰ |

| In palladium artefacts | The weld consists of precious metals with a minimum proportion of 700 ‰ |

It should also be noted that:

- any weld, including ordinary metal, can be used to weld precious metal to ordinary metal

- other joining methods, such as laser welding or other technical feasible non-metallic joining methods may be used.

C17. What coatings are authorised?

The following coatings are permitted:

| Precious metal to be coated | Permitted coating |

|---|---|

| Platinum | Rhodium, ruthenium and platinum |

| Gold | Rhodium, ruthenium, platinum and gold |

| Palladium | Rhodium, ruthenium, platinum, gold and palladium |

| Silver | Rhodium, ruthenium, platinum, gold, palladium and silver |

It should be noted that:

- ordinary metal coatings over precious metal are not authorised, with the exception of cases indicated in the above table, where rhodium and ruthenium may be used.

- surface chemical or heat treatments that change the colour of the alloy are permitted, provided that the fineness of the article is not altered by the coating.

Specific rules for mixed artefacts (made up of different precious metals)

The different metals that make up mixed artefacts must meet the following two conditions:

- They may not be completely coated by any of the metals shown on the above table.

- They may not be partially coated by any of the precious metals that make up the article

Specific rules for composite artefacts (consisting of precious metals and ordinary metals

The use of a precious metal coating on ordinary metal parts is not permitted on composite artefacts.

C18. Are bilaminate or plated articles (precious metal and ordinary metal) composite artefacts?

No. Bilaminate or plated articles are not considered composite artefacts because:

- composite artefacts are made up of precious metal parts and ordinary metal parts

- bilaminate or plated articles are made from ordinary metal (aluminium or brass) coated with silver and they are therefore not considered as articles of precious metal and are not marked by assay offices.

D1. What welds are permitted on gold chains manufactured by mechanical processes?

The following methods exist for making the assay office and sponsor’s marks:

- punching

- laser engraving

- tagging (by stamping on tags)

- any other marking method justified by advances in technology, provided that it is approved by the assay office director.

Economic operators may choose one of these methods for placing their sponsor’s mark. However, tagging is only permitted if the articles of precious metal are presented in aseptic packages. If the articles are not aseptically packaged, it is only possible to tag them if there are reasons to justify this, approved by the assay office director.

D2. If punching is not possible, what is the solution?

If the article cannot withstand punching, the assay office proposes one of the other methods:

- laser engraving

- tagging (by stamping on tags)

- any other marking method justified by advances in technology, provided that it is approved by the assay office director

There are some specific rules for tagging:

- It is only permitted if the articles of precious metal are presented in aseptic packages. If the articles are not aseptically packaged, it is only possible to tag them if there are reasons to justify this, approved by the assay office director.

- Tagging may only be done by assay offices.

D3. If an article has precious metal and ordinary metal, what mark is applied to distinguish the ordinary metal?

The mark to be applied depends on the type of article:

- Composite artefacts (made up of precious metal and ordinary metal)must bear the mark “+ METAL” or “+M” to distinguish them from jewellery artefacts. This mark must be applied to the precious metal part, alongside the official mark.

- Precious metal artefacts with an ordinary metal part, authorised due to technical reasonsmust be marked with “METAL” or “M”. This mark must be applied to the ordinary metal part.

D4. Can I ask the assay offices to manufacture or refurbish my sponsor's punch?

Yes. The owner of a sponsor’s mark (or person authorised by the owner) may request the following from Assay Offices:

- the manufacturing of sponsor’s dies and punches

- the refurbishment of the sponsor’s punch (the die must be submitted for this purpose).

D5. Can you put a trademark on an article of precious metal?

Yes, you can. Sponsor’s mark owners can mark their articles with their trademark (or with the trademark of others, if they are authorized to use it).

Trademarks can be affixed by marking, engraving or any other process.

D6. What rules apply to trademarks?

Each item can only be marked with one trademark. This mark:

- must be affixed to a place that is separate from the sponsor’s mark, to allow the assay office mark to be applied

- must not be confusable with the assay office marks or the sponsor’s marks, and must not include any indication related to fineness.

D7. Can other marks be applied? If so, what care should be taken?

Other marks may be applied. However, these marks:

- must not be confusable with any other marks provided for in the Legal Regime for Goldsmiths and Assay Offices (RJOC)

- must not indicate a fineness different to that represented by the assay office mark.

D8. Can I send a composite artefact to an assay office with the precious metal parts already marked with “+METAL” and “+M”?

No. These marks can only be made by the assay office.

D9. Is it possible to change an article after it has been marked by the assay office?

No. None of the following actions are possible once an article has been marked by the assay office:

- adding or replacing any part or component

- connecting it to other unmarked articles of precious metal.

If the article needs to be altered (e.g.: for repairs, such as enlarging a ring), it must be resubmitted to the assay offices to be assayed and marked. Any failure to submit the article is a very serious administrative offence.

D10. I have an article consisting of several pieces, but they are not welded together. Do they all have to be marked?

Pieces which are usually components of other pieces (e.g. spring rings, carabiners, fasteners, latch springs and other items) must always be marked whenever they are submitted to the assay office without the other components (e.g. if the operator submits a batch of spring rings to be individually sold). Marking is only not necessary when they have a weight that exempts them from marking (FAQ no. 79).

D11. I have an article of precious metal consisting of several pieces of precious metal. Is it mandatory to submit all the pieces to the assay office, even if their weight exempts them from marking?

The assay office mark exemption depends on the total weight of the article. All of the component metals (precious and non-precious) are weighed to calculate the total weight of an article, with the exception of non-metallic materials.

The following exemptions exist:

| Article fully or partially consisting of: | Exempt with total weight equal to or less than: |

| Gold | 0,5 grams |

| Platinum | 0,5 grams |

| Silver | 2 grams |

It should be noted that:

- if the article is made up of silver and gold or silver and platinum, the total weight must be 0.5 grams or less for it to be exempt;

- articles must always be presented in one piece for weighing (with precious and non-precious metals)

- in the case of articles containing parts that can be sold separately, these pieces may be weighed separately.

D12. Can I apply the fineness marker to pieces that are exempt from marking?

You can. The application of the fineness marker is the responsibility of economic operators in the jewellery sector.

D13. Can I ask an assay office to apply the fineness marker to pieces that are exempt from marking?

You can. The articles are assayed and the mark corresponding to the fineness determined by the assay is applied. This service has a cost.

E1. What rules should I take into account to exhibit and sell articles of precious metal to the public?

Only articles of precious metal that are marked may be exhibited and sold to the public. You must provide certain information to exhibit or sell them. In particular, you must:

- identify the precious metals and finenesses, the weight of the precious metal or metals and the types of gemological materials present

- identify the country that governs the finenesses of each item on sale, if known

- composite artefacts should bear the indication “consisting of precious metal and ordinary metal”

- metal coated or plated artefacts should have the indication “coated/plated on ordinary metal”

- if it is a watch bracelet or chain made from ordinary metal, it should have the indication “ordinary metal”

- if it is a used article of precious metal, it should have the indication “used”.

This information:

- must be provided, even if it is not requested by consumers

- may be provided in hard copy or digital format.

E2. Do all retailers have to display daily prices of precious metals?

Yes. All establishments selling articles of precious metals to the public must provide the daily prices of gold, silver, platinum and palladium.

These prices:

- must be affixed, even if they are not requested by the consumers

- may be provided in hard copy or digital format.

- can be found on the Banco de Portugal

E3. What activity title is needed to buy and sell new and used articles to the public?

A “jewellery retailer” activity title is required to sell articles to the public. However, if you want to buy items from private individuals, you need the title for the activity of “retailer for the purchase and sale of used articles of precious metal”.

E5. What rules should be followed by anybody selling used precious metal?

Economic operators trading in used precious metal must submit records of the purchase and sale of used articles of precious metal to the Judiciary Police department in the area of their establishment. This information must be provided – by post, email or fax – using a form made available by the Judiciary Police.

In addition:

- the articles may only be changed or sold (e.g: sold, exchanged, donated) 20 days after submitting the purchase records to the Judiciary Police

- these records must be kept for 5 years

- whenever necessary, they must provide these records to INCM, ASAE (Food and Economic Safety Authority) and to the Public Prosecution Service.

F1. What is the maximum weight of an article of precious metal to be exempt from an assay office mark?

The assay office mark exemption depends on the total weight of the article. All of the component metals (precious and non-precious) are weighed to calculate the total weight of an article, with the exception of non-metallic materials.

The following exemptions exist:

| Article fully or partially consisting of: | Exempt with total weight equal to or less than: |

|---|---|

| Gold | 0,5 grams |

| Platinum | 0,5 grams |

| Silver | 2 grams |

It should be noted that:

- if the article is made up of silver and gold or silver and platinum, the total weight must be 0.5 grams or less for it to be exempt;

- articles must always be presented in one piece for weighing (with precious and non-precious metals).

F2. Are articles exempt from the assay office mark also exempt from the sponsor's mark?

No. Articles must always have a sponsor’s mark before being sold. The sponsor’s mark is the mark identifying the economic operator who puts the article of precious metal on the market.

F3. Can an assay office mark be applied to an article that is exempt from this mark?

Yes. The assay office mark can be applied as an option when the sponsor’s mark is applied.

F4. Are mixed gold and silver items exempt from the assay office mark?

They are only exempt if they have a total weight of 0.5 grams or less. The total weight takes into account all the precious and non-precious metals that make up the article. For more information, see FAQ No. 11.

F5. I have an article of precious metal consisting of several pieces of precious metal. Is it mandatory to submit all the pieces to the assay office, even if their weight exempts them from marking?

The assay office mark exemption depends on the total weight of the article. All of the component metals (precious and non-precious) are weighed to calculate the total weight of an article, with the exception of non-metallic materials.

The following exemptions exist:

| Article fully or partially consisting of: | Exempt with total weight equal to or less than: |

| Gold | 0,5 grams |

| Platinum | 0,5 grams |

| Silver | 2 grams |

It should be noted that:

- if the article is made up of silver and gold or silver and platinum, the total weight must be 0.5 grams or less for it to be exempt;

- articles must always be presented in one piece for weighing (with precious and non-precious metals)

- in the case of articles containing parts that can be sold separately, these pieces may be weighed separately.

F6. Can I apply the fineness marker to pieces that are exempt from marking?

You can. The application of the fineness marker is the responsibility of economic operators in the jewellery sector.

F7. Can I ask an assay office to apply the fineness marker to pieces that are exempt from marking?

You can. The articles are assayed and the mark corresponding to the fineness determined by the assay is applied. This service has a cost.

G1. What is credit granting?

It is a measure that allows the economic operator to pay invoices after the work is done with the aim of improving the Assay Office services, in particular the waiting time for customer service.

It is also a measure of economic support to the sector.

G2. To whom does it apply?

It applies to all operators who, in the last 3 years, had an average invoicing of at least € 100,00/year.

G3. What are the credit limits allocated?

The credit allocated depends on the average annual invoicing of each economic operator:

(Average annual billing time-lag) Credit limit to be assigned

>€ 5,000/year 10% of the ascertained average amount

€ 1,500 – €5,000/year € 500

€ 100 – € 1,500/year € 100

< €100/year Not applicable

G4. I have an average annual billing of € 4525.00. When the work is completed, how much may I have to pay later on?

You can pay up to € 500,00 within 30 days.

G5. And if I'm a new client, can I have access to this measure?

Yes, new customers will be assigned credit limits according to the invoicing levels achieved.

G6. I'm a new customer and I predict that I will reach the desired levels of billing. How can I have access to credit?

If you find that you will reach the billing levels described in the table above, you may apply for credit via email to: contrastarias@incm.pt

The application will be examined and decided in the light of each particular case.

G7. Can the granted credit amounts be changed?

Yes. A re-evaluation of the credit limits and of benefitting customers will be made annually.

G8. How and when can I pay the bills?

The invoices shall be paid by ATM reference (Multibanco) within 30 days after the work conclusion as follows:

- By homebanking (Online bank transaction)

- In an ATM (Cash Machine)

G9. When the work is done, may I keep paying in cash?

Yes. You can continue to pay in cash and by ATM (Multibanco) when you get the work done.

H1. What are the modalities of safe transportation services?

There are currently two modalities of safe transportation service:

- Secure Transportation Service (STS), available for the districts of Braga, Aveiro and Coimbra

- Declared Value Transportation Service (DVTS), available in mainland Portugal, Azores and Madeira

H2. What does Safe Transportation Service (STS) stand for?

The STS is one of the modalities of the secure transportation service provided by the Assay Office ensuring the transportation (collection and delivery) of articles, for the performance of Assaying and Marking services.

With this service, the Economic Operator does not need to go to the Assay Office.

Districts covered:

- Braga

- Aveiro

- Coimbra (Figueira da Foz, Coimbra, Montemor-o-Velho, Condeixa-a-Nova, Soure, Cantanhede, Mira)

H3. What is the Declared Value Transportation Service (DVTS)?

The DVTS is one of the modalities of the secure transportation service provided by the Assay Office, ensuring the delivery of items after completion of the Assaying and Marking service.

With this service, the Economic Operator does not need to go to the Assay Office in order to receive the work. The latter will be delivered to the address you indicate.

You may also choose this service provided by the Postal Services in order to send work for assaying and marking to the Assay Office. However, in that case you will have to do so on your own initiative and visit a Post Office desk.

Covered area: Mainland Portugal, Azores and Madeira

H4.What are the advantages for the economic operator?

The advantages of this service for the Economic Operator are:

- More security

- More comfort

- Less travel costs

- Less time spent on travel

H5. On what days is the Safe Transportation Service (STS) available?

Braga: working days

Aveiro: Tuesdays and Fridays

Coimbra: Tuesdays and Fridays

H6. How can I request the Safe Transportation Service (STS)?

You must send an email to contrasteseguro@incm.pt with a completed Delivery Note as attachment until 16:00 PM the day before.

H7. How can I request the Declared Value Transportation Service (DVTS)?

You can do so by filling a Delivery Note, where you must indicate the declared value of all articles.

In order to calculate that value, click here.

H8. How can I send work to the Assay Office with Declared Value?

You should consult the Post Office website in order to know how to send work and to calculate the cost of this service.

H9. What is the maximum weight/value I can send for each service?

Safe Transportation Service (STS): 15 kilograms. If this figure is exceeded, a supplementary cost of 5 EUR/15 kg will be charged.

Declared Value Transportation Service (DVTS): 2 kg and EUR 5000

H10.What is the price of these services?

Safe Transportation Service: Free of charge;

Declared Value Transportation Service: It depends on the weight and declared value of the work, e.g. 8.10 EUR for 1 delivery of 277 grams of silver. In the case of gold, it is possible to transport up to 100 grams of gold per delivery, since this service is limited to 5000 EUR of declared value;

Both services are added by the handling costs specified in the Assay Office Price Table:

- Work received in the absence of the operator, if applicable

- Work packaged in the absence of the economic operator with quality control

- Packaging of articles

FAQ INSPECTION AND ADMINISTRATIVE OFFENCES

I1. What inspection competences does Imprensa Nacional - Casa da Moeda have?

- To inspect, investigate and decide on administrative offence procedures relating to:

- Assaying;

- Marking of articles of precious metal;

- Titles for accessing activities regulated by the Legal Regime for Goldsmiths and Assay Offices, approved by Law no. 98/2015, of 18 August, as amended by Decree-Law No. 120/2017 (RJOC).

- Application of fines and ancillary penalties under the RJOC.

I2. What is inspection?

Inspection is a group of procedures aimed at verifying that the inspected entity meets its obligations, as described in the Inspection Regulation, published in the DRE 2nd Series, no. 251, of 31/12/2018.

I3. Who does it apply to?

It applies to all natural and legal persons engaged in activities subject to the RJOC.

I4. What do the inspection and investigation powers consist of?

The inspection and investigation powers consist of:

- Investigating and taking statements from offenders and witnesses;

- Taking examples and samples of products or other goods that are produced;

- Carrying out or ordering any analyses of these products that may be necessary;

- Photographing, filming and other ways of collecting proof of offences;

- Issue notices of administrative offences;

- Prepare and perform all actions necessary for investigating and prosecuting administrative offences referred to during actions or notices of offences.

I5. What is the purpose of inspection activities?

Inspection activities aim to collect data and ascertain facts, by means of procedures and techniques applied by the inspection team, with a view to verifying that the inspected entity meets its obligations.

I6. Who is the Inspection Technician?

The inspection technician is an INCM employee who performs inspection actions and their related procedures.

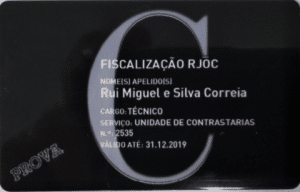

I7. How is an Inspection Technician identified?

The Inspection Technician can be recognized by a professional identification card:

I8. What types of inspection actions are there?

There are two types:

- In-person actions – The inspection team visits premises that are open to the public where articles of precious metal are bought and sold, and interacts with the economic operator;

- Remote actions – information requests or other types of action without interacting with the economic operator.

I9. What is an Inspection Report?

A document issued by the Inspection team describing the objective of the inspection activity, the results obtained and, if applicable, the existence of an offence, indicating the applicable regulations and penalties that are provided for.

I10. What should be done if there are signs that an offence has been committed?

The inspection team issues a notice.

I11. What is a notice?

A document describing the fact, the offence, the violated regulation and the corresponding penalty, drawn up by the Inspection team.

I12. What are the rights of inspected entities?

Inspected entities have the following rights:

- To request the identification of the inspection team;

- To monitor the inspection process and the actions taken;

- To be informed of the Inspection report;

- To oppose any actions or measures that restrict basic rights;

- To make statements and defend themselves during the proceedings.

I13. What are the duties of inspected entities?

Inspected entities have the following duties:

- To provide relevant data and information about their activity;

- To allow the inspection team access to the premises;

- To make a representative available to provide information during the inspection activity.

I14. Is the confidentiality of the personal data of inspected entities guaranteed?

Yes. The confidential treatment of data and information resulting from inspection activities is guaranteed during the inspection procedure.

I15. Do the assay offices have the duty to cooperate with other entities?

Without prejudice to their own powers, the assay offices work with the ASAE, with the Tax Authorities, with the Judicial Police and with police authorities under the scope of application of the Legal Regime for Goldsmiths and Assay Offices (RJOC).

I16. What is the Annual Inspection Plan?

The Annual Inspection Plan is a document that sets out the objectives to be achieved and the planned inspection activities to be carried out during each calendar year.

I17. Can the inspection team seize articles of precious metal?

Yes. The inspection team can seize articles of precious metal that have been used to, or are intended to commit a violation of the Legal Regime for Goldsmiths and Assay Offices (RJOC).

I18. Is there guaranteed independence between the inspection team and assay office services?

The segregation of functions between the inspection team and assay offices is guaranteed by autonomous processes and teams and independent controls.

I19. How will the inspection team operate?